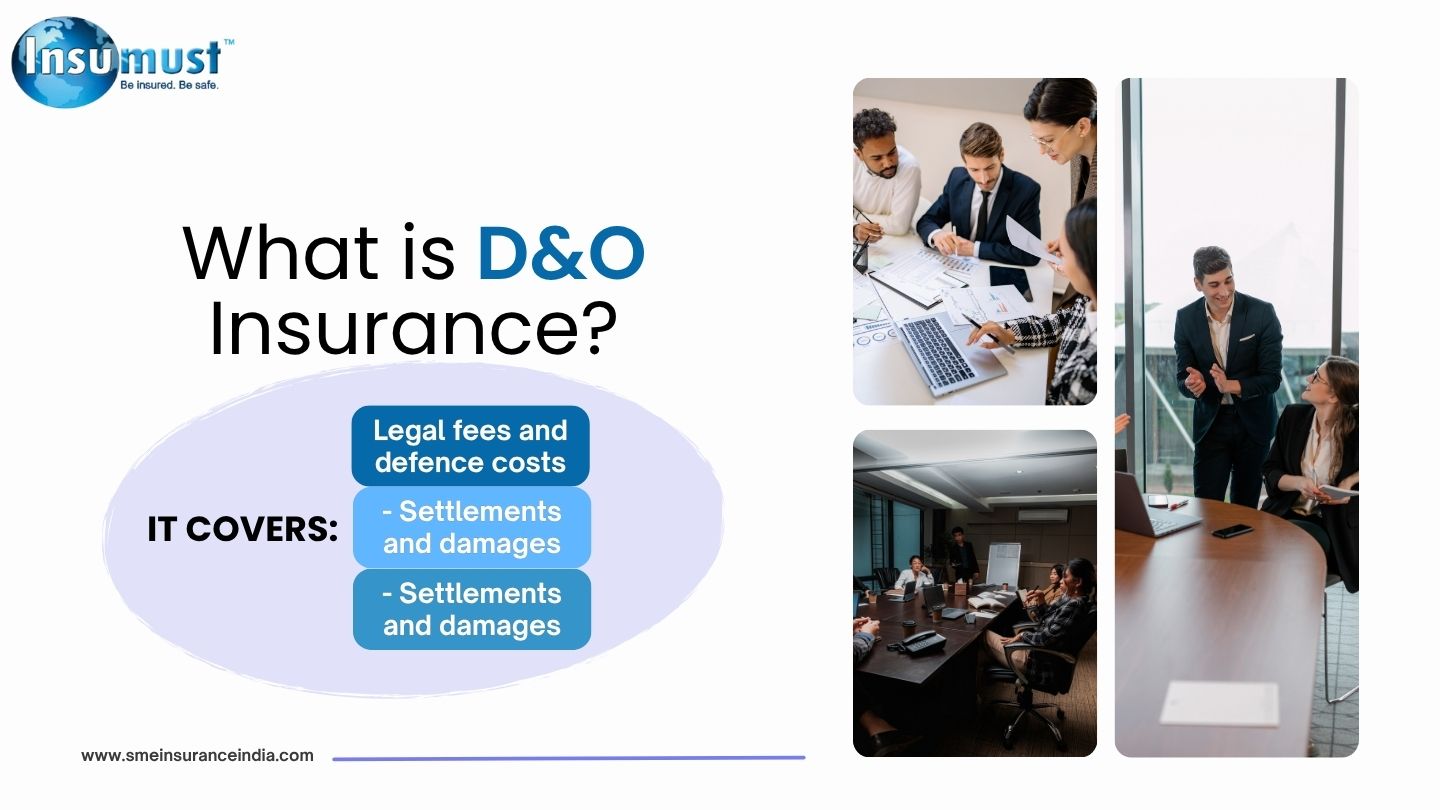

What is the real cost – With D&O vs Without D&O

The Real Cost: With D&O vs Without D&O When considering D&O Insurance, it’s essential to weigh the costs and benefits. Here’s a comparison: With D&O Insurance: – Premium costs: You’ll pay annual premiums, which can range from a few thousand to hundreds of thousands of rupees, depending on your business size, industry, and risk level. […]